Note: This post was originally published in the August 2016 issue of Value Investing Almanack. To read more such posts and other deep thoughts on value investing, business analysis and behavioral finance, click here to subscribe to VIA.

On April 10, 2003, Pepsi announced a contest called “The Pepsi Billion Dollar Sweepstakes”. It was scheduled to run for 5 months starting from May in the same year.

For the contest, Pepsi printed one billion special codes which could be redeemed either on their website or via postal mail. According to Pepsi’s estimate, about 200-300 million of these codes were redeemed. Out of these, 100 codes were chosen in a random draw to appear in a two-hour live gameshow-style television special. Each of these 100 people were assigned a random 6-digit number, and a chimpanzee (to ensure a truly random number and of course to rule out any monkey business) backstage rolled dice to determine the grand prize number. This number was kept secret and the 10 players whose numbers were closest to it were chosen for the final elimination. On the evening of September 14, the final day of the contest, the event, titled Play for a Billion, was aired live. If a player’s number matched the grand prize number, he would win US$ 1 billion.

(Source: Wikipedia)

Given the scenario, it was highly unlikely that anyone would win a billion dollar. The chances were literally 1 in a billion. In spite of that, Pepsi was unwilling to bear the risk of the possible billion-dollar prize. So they arranged for an insurance company to insure the event. They paid US$ 10 million to Berkshire Hathaway to assume the risk. Yes, Warren Buffett’s Berkshire Hathaway. The same guy who is famous for his two iron rules –

1. Never lose money

2. Don’t forget rule number 1.

Then why would Buffett expose his company to such a big risk for a relatively paltry premium of US$ 10 million? Isn’t this akin to playing Russian roulette?

Remember Russian roulette? Here’s how a Russian roulette is played –

Imagine you are offered US$ 10 million to put a revolver, containing only one bullet in the six available chambers, to your head and pull the trigger. If you survive you win the US$ 10 million prize. The odds of winning are more than 80 percent. The upside is huge i.e. US$ 10 million. The downside – loss of life i.e., death – is even bigger.

Should you play this game? What if the prize money is US$ 1 billion and the revolver has thousand chambers instead of just 6 with a single bullet i.e., a minuscule probability of death and an enormous upside?

Warren Buffett once wrote that he would never play this kind of game, where the downside is unacceptable to him, no matter how low the probability of the outcome. Then why is he risking his US$1 billion?

Isn’t Buffett contradicting himself?

In his 2003 letter to shareholders, he wrote –

Ajit [Jain] writes some very unusual policies. Last year, for example, PepsiCo promoted a drawing that offered participants a chance to win a $ 1 billion prize. Understandably, Pepsi wished to lay off this risk, and we were the logical party to assume it. So we wrote a $ 1 billion policy, retaining the risk entirely for our own account. Because the prize, if won, was payable over time, our exposure in present-value terms was $ 250 million. (I helpfully suggested that any winner be paid $ 1 a year for a billion years, but that proposal didn’t fly.) The drawing was held on September 14. Ajit and I held our breath, as did the finalist in the contest, and we left happier than he. PepsiCo has renewed for a repeat contest in 2004.

These kind of cases are quite rare for most insurance operations. For one, unlike say the auto insurance business, here we don’t have sufficient past data to make reasonable calculations about odds of win/loss. We also don’t have the option to spread the risk of loss among millions of premium-paying customers, or the time between receiving the premium and paying the loss to invest the float.

Instead, here there are only two possible outcomes. Either Berkshire earns the US$ 10 million that will have absolutely no meaningful effect on Berkshire’s bottom line or Berkshire will lose the net present value of US$ 1 billion paid out over 40 years. That amount is still small but certainly not insignificant.

One clear benefit of Buffett’s willingness to make such a bet is that it establishes Berkshire’s reputation as an insurer which can cover such events. So the contest proved a publicity bonanza not only for Pepsi but also for Warren Buffett. I am sure there are many other companies (like Pepsi) who would love to exploit the publicity created by announcing such contests and delegating the risk to Berkshire. That creates another unique source of revenue for Buffett.

Still, the question remains –why would Buffett make such a bet when the upside is insignificant?

We all know that Buffett is super-smart. There’s something which he knows and understands about Risk that a common investor doesn’t. When he underwrites these unusual and risky looking policies, he is essentially willing to look foolish but not be foolish.

In other words, Buffett is not loss averse. He is risk averse. To understand this statement, we need to understand the difference between risk aversion and loss aversion.

Loss Aversion is Human Nature

We, humans, have a natural tendency to be loss averse. What do I mean by that?

Let me take an example from Jason Zweig’s book Your Money and Your Brain. He writes –

Imagine that you can choose between winning $3,000 for sure, on the one hand, or a gamble with an 80% chance of winning $4,000 and a 20% chance of winning nothing. If you’re like most people, you will pick the sure thing.

Next, imagine that you can choose between losing $3,000 for sure, or a gamble with 80% odds of losing $4,000 and 20% odds of losing nothing. What would you do now? In this case, people reject the sure thing and take the gamble 92% of the time.

You would be better off taking the gamble in the first example and the sure thing in the second one–the opposite of what you probably chose. On average, an 80% chance of winning $4,000 is worth $ 3,200 (.80 x 4,000 = 3,200). So, in the first example, the gamble has an “expected value” $200 higher than the sure thing. By the same rule, an 80% chance of losing $4,000 leaves you $3,200 poorer. And in the second case, you logically should favour the sure loss of $3,000; on average, it will leave you with $200 more. But it’s hard to be strictly logical in these choices because the idea of losing money triggers potential regret in your emotional brain. If you take the 80% gamble of winning $4,000 and win nothing instead, you will kick yourself for missing out on the $3,000 sure thing. And a 100% chance of losing everything feels a lot worse than the risk of an even bigger loss coupled with a small shot at losing nothing. Doing anything – or even thinking about doing anything– that could lead to an inescapable loss is extremely painful.

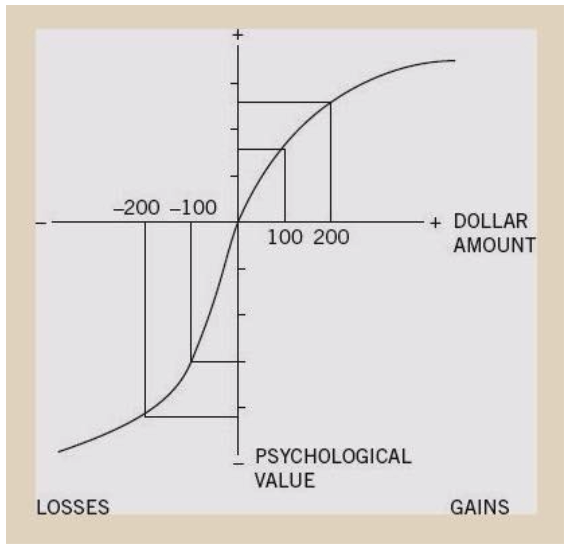

In simpler words, or rather in Charlie Munger’s words, “The quantity of a man’s pleasure from a ten-dollar gain does not exactly match the quantity of his displeasure from a ten-dollar loss.” And this is the foundation of Daniel Kahneman’s work on Prospect Theory.

A typical outcome of loss aversion is the propensity to sell our stocks as soon as the price drops. This tendency results in most investors buying the stock when the market is rising and selling out when the prices collapse. It’s nothing but a severe distaste for possibility of loss. While there may be a persuasive evolutionary explanation for loss aversion, as we’ll see later, it is not good for money management.

What majority of the investors fail to realise is that possibility of loss doesn’t always translate to risk. To wrap our heads around this subtle distinction, let’s explore what exactly is a risk.

What is Risk?

The real risk associated with any stock (or for that matter, any investment) is the risk of ‘permanent loss of capital’. A permanent loss of capital occurs when a stock goes down because of worsening business operations and stays down for a very long time or even forever. For example, if a company goes bankrupt, or its earnings power drops permanently, then shareholder value will also become permanently diminished.

Risk is a perception in each investor’s mind that results from analysis of the probability and amount of potential loss from an investment, writes legendary investor Seth Klarman, “If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky.”

Another way to understand risk is to invert the question and see what is not a risk. Contrary to popular belief, volatility isn’t necessarily a risk. Many investors consider price fluctuations to be a significant risk i.e., if the price goes down, the investment is seen as risky regardless of the fundamentals.

Are short-term price movements really a risk? Perhaps yes but only for certain investors under specific conditions. So if you’re using debt (margins) to buy stocks, volatility is certainly a risk for you. Volatility alone isn’t a risk. However, debt plus volatility is a risk.

We just said that price volatility isn’t a source of risk. But there is one situation where price becomes a factor in risk. Not the market price, but the price at which an asset/stock is acquired. In fact, all other things being equal, the price of an asset is the principal determinant of its riskiness. In simpler words, overpaying for an asset increases the risk.

Howard Marks, in his 2013 letter to investors, wrote –

No asset is so good that it can’t be bid up to the point where it’s overpriced and thus dangerous. And few assets are so bad that they can’t become under-priced and thus safe (not to mention potentially lucrative).

An investor who doesn’t use leverage has enormous staying power because markets can stay irrational longer than one can stay solvent (and sane). So avoiding debt is one way to ensure that you don’t incur a permanent loss of capital because of margin calls or debtors forcing you to sell your positions.

Martin Whitman, in his book The Aggressive Conservative Investor, writes –

Macro data such as predictions about general stock market averages, interest rates, the economy, consumer spending, and so on are unimportant for safe and cheap investors as long as the environment is characterized by relative political stability and an absence of violence in the streets.

The concept of risk is meaningless unless it is preceded by a modifying adjective. There exist market risk, investment risk, credit risk, failure-to-match-maturities risk, commodity risk, terrorism risk, and many more types of risk. The idea of general risk is not helpful in a safe and cheap analysis. When financial academics and sell-side analysts refer to risk they almost always mean only market risk and usually very short-run market risk.

In fact, the most basic definition of risk is – not knowing what you’re getting into. You need to understand the business whose stock you are buying. Always remember, risk comes from not knowing what you are doing, in life and in stock market investing. Because when you don’t know what you are doing, you can lose it all…permanently.

Loss is Not Risk

Unlike the notion of loss, risk can’t be reduced to a single idea. Buffett’s rules of investing – “Don’t lose money,” and “Never forget the first rule.” – confuses a lot of new investors. After all, the surest way of not losing money is to put it in fixed deposits. Right?

While it’s true that shunning loss should be the primary goal of every investor, the dictum is incorrectly interpreted that one should never incur any loss at all. This is a sign of a typical loss averse mindset which, as we have seen above, is a behavioural bias.

“Don’t lose money” means that over several years an investment portfolio should not be exposed to appreciable loss of principal. It also means that any loss in your portfolio shouldn’t set you back so severely that you can’t continue investing.

In fact, being extremely loss-averse can increase the risk.

How? An extremely loss-averse investor would prefer putting all his money in safe bank deposits which over long term lose its value because of taxation and inflation. An apple that cost Rs 100 today will cost you Rs 108 next year because of an inflation rate of 8 percent. However, a bank deposit will fetch you only Rs 106 (after tax) in one year. Which means putting money in the bank for one year took away your ability to buy an apple.

What looks safe in short term is far riskier in the longer term.

Refer to the example from Jason Zweig’s book. By reframing the problem from a “gain frame” to “loss frame”, we nudged you from sure shot (conservative) option towards the riskier option (gambling). Loss aversion made you a risk-seeking person.

“As an investor,” writes Prof. Bakshi in his insightful post, “you should seek businesses which are risk averse but not loss averse. You should avoid businesses who don’t want to even experiment a bit because they are petrified of losses should the experiments fail.”

Another Billion Dollar Bet

Charlie Munger once wrote –

We will never play financial Russian roulette with the funds you’ve entrusted to us, even if the metaphorical gun has 100 chambers and only one bullet. In our view, it is madness to risk losing what you need in pursuing what you simply desire.

Notice the last sentence which I have highlighted. Risk is betting what you need in hope of getting what you desire. That’s what makes Warren Buffett’s billion-dollar bet not risky for him. He can afford to lose a billion dollar because a billion dollar is less than 1% of Berkshire’s net worth. Buffett is risking a large amount of money, but in terms of his expected loss, he’s not risking a whole lot. If $1 billion were going to ruin him, he wouldn’t. But it’s not going put Warren Buffett out of business. Not many insurance companies have the kind of financial strength Berkshire has. Berkshire’s bets would be very risky for other mom and pop insurance operations and that’s why the likes of Pepsi turn to Buffett, time and again.

Precisely because there aren’t many insurance companies willing to insure such events, Buffett is happy to take more such bets. Moreover, he’s getting paid disproportionately for the risk he’s assuming. The expected value of his bet is far-far less than US$ 10 million (the probability of someone winning the Pepsi’s challenge multiplied by prize money). If you calculate, it would probably be less than 100 dollars. So US$ 10 million is a pretty awesome deal for Buffett. I am sure he wouldn’t shy away from insuring a couple of dozens more such events.

No wonder Buffett goes out of his way to not just find but create such deals for Berkshire. After Pepsi event, Buffett suggested the US$ 1 billion contest to Quicken Loans founder Dan Gilbert in 2014. Gilbert and Buffett announced a billion dollar prize for anyone who could pick a perfect bracket in the annual men’s NCAA basketball tournament known as March Madness. According to one estimate, the odds of picking every winner correctly in a 64-team bracket are less than 1 in 9 quintillion. The odds of Buffett having to pay out reach about 1 in 10,000 in the Quicken Loans contest if all 10 million entrants have basketball knowledge. The odds of correctly forecasting 67 games are extraordinarily thin.

(Source: Warren Buffett will pay you US $1-billion…)

Even a skilled handicapper would have about a 1-in-1-billion chance of completing a perfect bracket. “Millions of people play brackets every March, so why not take a shot at becoming $1 billion richer for doing so,” Buffett said in the statement. “While there is no simple path to success, it sure doesn’t get much easier than filling out a bracket online.”

And it’s not that Buffett will silently watch the winner take away his billion dollars. At any point, if he feels that odds are turning against him, he would make a move. “If you get to the Final Four with a perfect bracket, I may buy you out of your position,” Buffett said. “I’ll make you an offer you can’t refuse.” He’s ready to bear the losses but he’s also vigilant if the risk increases at any point, he’s ready to curb that risk.

And that’s another important lesson that every investor needs to learn from Warren Buffett. Be risk averse but don’t be afraid to make mistakes or take an occasional loss.

Conclusion

Every great investor intuitively understands this distinction between loss aversion and risk aversion. Seth Klarman says –

To maintain a truly long-term view, investors must be willing to experience significant short-term losses; without the possibility of near-term pain, there can be no long-term gain.

Great investors recognize another uncomfortable reality about probability, writes Michael Mauboussin, “the frequency of correctness does not really matter, what matters is how much money you make when you are right versus how much money you lose when you are wrong.”

In other words, we like to be right a lot more than to be wrong. This concept is very difficult to put into operation because of loss aversion.

Volatility is a friend of risk-averse investor and an enemy of loss averse investor. Someone who hasn’t made peace with short term notional losses, who hasn’t learnt to deal with daily price fluctuations because of market sentiments, is going to have an extremely tough time investing his or her money in stock market.

People who are risk averse get benefitted from people who are only loss averse.

Risk in investing, thus, comes not from the companies, institutions, or securities involved. It comes from the behaviour of investors. Their tendency to let the emotions of greed and fear control their actions.